Financial Analysis Dept. Report: June 30, 2020

Table of Contents

Executive Summary

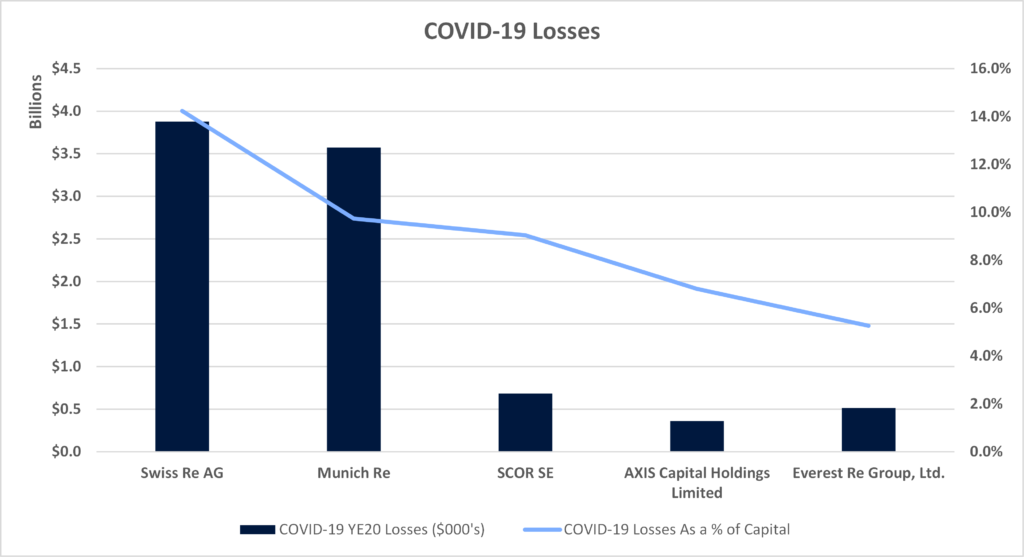

- Diligently monitoring market changes including COVID-19 pandemic, possible increased market participants, and adverse loss reserve development. Based on reported List of Approved Surplus Line Insurers (LASLI) Group’s COVID-19 claims from Standard & Poor’s Market Intelligence platform, the largest exposure to COVID-19 claims as a percentage of total capital were reported by Swiss Re AG (14.2%) and Munich Re (9.7%).

- Premium registered in 2021 year-to-date (YTD) was $3.2 billion for companies on the LASLI and $1.2 billion for companies (primarily Lloyd’s) not on the LASLI. Premiums from LASLI and Non-LASLI companies increased by 13.0% and 10.2%, respectively, compared to the same period in 2020. Non-LASLI companies with a large California presence are monitored, but do not undergo the extensive financial review as LASLI companies.

- Total number of LASLI companies stands at 128, flat from December 31, 2020.

- Several companies applying for the LASLI are in the pipeline—three are currently with the California Department of Insurance (CDI), two are being reviewed by the SLA, and one additional application recently was received by CDI. Of the applicants, half already have affiliates on the LASLI, and the others potentially will be the group’s first company on the list. Potential lines of business identified by the applicants include Homeowners, Earthquake, Commercial Auto, and Inland Marine.

- Multiple merger and acquisitions deals have been completed in 2021 including Progressive Corporation’s acquisition of LASLI Insurer Protective Insurance Corporation, its first subsidiary on the LASLI. In addition, the acquisition of Norcal Group by ProAssurance Corporation resulted in the combination of two LASLI Groups writing Medical Professional Liability insurance in California.

- Any questions are welcomed and can be sent to Glenn Leung at Gleung@slacal.org.

Team Update

Attrition of one team member during 2021 and an additional one planned for July. Successful addition of one new team member during 2021, with active recruitment for two additional positions ongoing. Promotion of one team member to Financial Analyst during the year. Strong cross training and development has led to mitigated impacts of the attrition. We continue to enhance the skills and knowledge of the team with an eye towards development and succession planning. The management team continues to meet with the CDI quarterly to discuss surplus line matters and LASLI applications.

Project Update

FA Dept Reengineering in the Master Innovation Plan – Focus is on improving efficiency, simplifying processes, enhancing team effectiveness, updating research tools and portfolio management capability, and shifting focus from compliance to risk management and monitoring (moving from 50/50 compliance/risk management to 25/75).

Projects planned for 2021 or currently in progress include:

- Updating the source of financial data in the SLA database due to the NAIC decision to no longer provide the SLA direct access to the NAIC I-SITE+. The FA team is working on updating the source of our data to Standard & Poor’s Market Intelligence database.

- Updating the current Security Summary Review (SSR) template with a goal of simplifying the process and improving consistency while still maintaining flexibility. Updates for 2021 will focus on the writing component of the SSR procedures.

- Incorporate project management tools with a goal of increasing efficiency, accountability, and transparency on team.

- Testing CDI LASLI Portal to confirm updates made by CDI address errors received by the LASLI Insurers submitting the required LASLI filing documents. In addition, the FA team will work on creating training videos for the CDI LASLI Portal.

- Cross Departmental Training to better understand all the data that is captured by the SLA and incorporate that data into the solvency analysis.

Projects completed in 2021 include:

- Redesigning document checklist used to log receipt and compliance of required documents filed by the LASLI carriers/applicants with the Financial Analysis Department. The document checklist was updated for changes to filing requirements and the evolving business needs of the SLA.

- Interdepartmental gap placement filing team created at the SLA to review placements made under California Insurance Code (CIC) Section 1765.1(f)(1). The team includes representatives from Financial Analysis, Education and Compliance, and Data Analysis teams at the SLA, and facilitates improved communication and consistency in the review of these placements.

Premium Registered – 2021 (January through May)

| Total Premium Registered ($000's) | Market Share | Insurer Count | ||||

| YTD 2021 | YTD 2020 | YTD 2021 | YTD 2020 | 5/31/2020 | 5/31/2020 | |

| LASLI Insurers | ||||||

| US Insurers | 3,062,434 | 2,698,471 | 68.7% | 67.9% | 109 | 108 |

| Non-US Insurers (all IID listed) | 145,068 | 140,404 | 3.30% | 3.5% | 19 | 19 |

| SUBTOTAL | 3,207,502 | 2,838,875 | 71.9% | 71.50% | 128 | 127 |

| Non-LASLI Insurers | ||||||

| Lloyd's Syndicates | 793,375 | 692,799 | 17.80% | 17.40% | ||

| US Insurers | 269,218 | 297,621 | 6.00% | 7.50% | ||

| Non-US Insurers | 160,141 | 119,702 | 3.60% | 3.00% | ||

| Others (Suspense, Unknown Insurer, etc.) | 4,274 | 2,851 | 0.10% | 0.10% | ||

| SUBTOTAL | 1,227,009 | 1,112,973 | 27.50% | 28.00% | ||

| TOTAL - LASLI/Non-LASLI Insurers | 4,434,510 | 3,951,848 | 99.50% | 99.50% | ||

| Taxable Fees | 24,303 | 19,827 | 0.50% | 0.50% | ||

| TOTAL - Premium and Fees Registered 1, 2 | 4,458,814 | 3,971,675 | 100.00% | 100.00% | ||

Note: The breakdown of premium registered for prior year by insurer type is based on insurers’ status as of the prior year.

The LASLI company insurer count includes all companies on the LASLI regardless of whether they had premium registered.

- Total premium and fees registered through May 2021 increased 12.3% year-to-date compared to the same period prior year.

- Premium registered from LASLI insurers is primarily from US ($3.1 billion) versus Non-US ($0.1 billion) companies. The count of LASLI insurers is up one from May 2020 to 128.

- Premium registered from Non-LASLI insurers continue to be led by Lloyd’s syndicates ($0.8 billion, up 14.5% from $0.7 billion in the same period for 2020).

- Besides Lloyd’s, the two largest Non-LASLI insurers by premiums registered are Associated Electric & Gas Insurance Services Ltd. (Non-US; $75.3 million) and Kinsale Insurance Company (US; $53.7 million). Other Non-LASLI insurers with significant premium registered include Trisura Specialty Insurance Company (US; $43.2 million) and Progressive Corporation subsidiary, Blue Hill Specialty Insurance Company, Inc. (US; $35.5 million).

- SLA Financial Analysis Department monitors LASLI insurers closely—a benefit to the broker community as well as to the California home state insureds. Non-LASLI insurers with a significant California market presence are monitored, though reviews are more cursory.

LASLI Applicants

| Insurer | Domicile | Application Status |

| Bridgeway Insurance Company | Delaware | Pending CDI CAB's review |

| Republic-Vanguard Insurance Company | Arizona | Pending CDI CAB's review |

| AzGUARD Insurance Company | Nebraska | Pending CDI CAB's review |

| Clear Blue Specialty Insurance Company | North Carolina | SLA review in progress |

| Grant Assurance Corporation | Vermont | SLA review in progress |

| Professional Security Insurance Company | Arizona | Application received by CDI |

| Sutton Specialty Insurance Company | Oklahoma | Application withdrawn |

- CDI is reviewing three LASLI Applications and the SLA is reviewing two other LASLI Applications. One other application received by CDI but not yet released to the SLA.

LASLI Withdrawals Since NRRA in 2011

| Insurer Type | Total | Withdrew Due to NRRA | Withdrew from Surplus Line Market | Withdrew for Other Reasons |

| Non-US | 20 | 10 | 7 | 3 |

| US | 19 | 1 | 4 | 14 |

| SUBTOTAL | 39 | 11 | 11 | 17 |

| Lloyd's Syndicates | 78 | 78 | 0 | 0 |

| TOTAL | 117 | 89 | 11 | 17 |

- No LASLI withdrawals during the first six months of 2021.

Premium Registered By AM BEST Financial Strength Rating Year-To-Date (January through May)

Chart excludes premiums in suspense and other premiums that are not allocated to a company

- of rated LASLI companies is strong with AM Best financial strength rating of Excellent or stronger. As a % of premium registered by AM Best financial strength rating, credit quality of LASLI companies is somewhat stronger than Total (All Companies). Berkshire Hathaway, Chubb, and Tokio Marine are the largest A++ operating groups by premium registered for the last five years.

- Lloyd’s syndicates, including those with missing or invalid syndicate numbers, wrote $0.8 billion (17.8%) of 2021 year-to-date premium and fees registered, making it the largest portion of the Non-LASLI category. All Lloyd’s syndicates reflect the Lloyd’s market AM Best financial strength rating of A.

- Insurers with B++ ratings wrote $7.5 million (0.2%) of 2021 year-to-date premium registered and consisted of Knight Specialty Insurance Company (Knight Specialty) and Conifer Insurance Company (Conifer). Both are non-LASLI companies.

- Knight Specialty’s ($5.6 million premium registered) rating was affirmed in January 2021 and reflects Knight Specialty’s operating and process enhancements instituted by its management team, which have resulted in steadily improving operating performance and significantly reduced adverse prior year loss reserve development. The company has strengthened the monitoring and control of its general agent partners and third part adjusters in claims settling and enhanced its underwriting guidelines, which have contributed to the turnaround. While operating performance has shown improvement, the potential for volatility remains as open claims from terminated programs are settled and active programs mature. Volatility may also result from elevated common stock leverage relative to the industry.

- Conifer’s ($1.9 million premium registered) rating was affirmed in February 2021 and has a stable outlook. AM Best expects that the group’s business profile, focusing on its niche lines expertise, should generate sustainable underwriting and operating results such that minor volatility from any future adverse development will not materially impact capital adequacy in the negative. The group has spent the past two to three years exiting nearly all the segments that significantly underperformed management’s optimistic profitability expectations.

AM BEST Financial Strength Rating Actions and Outlook/Implication LASLI Insurers – 2020 and 2021

| AMB Financial Strength Rating Outlook / Implication 1 | AMB Financial Strength Rating Actions 1 | AMB Financial Strength Rating 1 | AMB Ultimate Parent 2 | YTD 2021 Premium Registered ($000's) 3 | YTD 2021 Premium Registered (% of Total) 3 |

| Stable | Affirmed | VARIOUS | 3,008,312 | 93.80% | |

| Downgraded | A | AXIS CAPITAL HOLDINGS LIMITED | 48,192 | 1.50% | |

| Upgraded | A+ | AXA SA | 258 | 0.00% | |

| Stable Total | 3,056,762 | 95.30% | |||

| Negative | Affirmed | A | UNITED FIRE GROUP, INC. | 11,681 | 0.40% |

| Downgraded | A- | JAMES RIVER GROUP HOLDINGS, LTD. | 48,235 | 1.50% | |

| Under Review | A- u | HALLMARK FINANCIAL SERVICES, INC. | 53,898 | 0.90% | |

| WATFORD HOLDINGS LTD. | 2,163 | 0.10% | |||

| Negative Total | 62,079 | 1.90% | |||

| Developing | Downgraded Under Review | A- u | VAULT HOLDINGS, LLC | 5,780 | 0.20% |

| Under Review | A- u | HALLMARK FINANCIAL SERVICES, INC. | 24,561 | 0.80% | |

| A- u | CORE SPECIALTY INSURANCE HOLDINGS, INC. | 19,745 | 0.60% | ||

| A- u | PROASSURANCE CORPORATION | 2,708 | 0.10% | ||

| Developing Total | 52,794 | 1.60% | |||

| Positive | Affirmed | A | SELECTIVE INSURANCE GROUP, INC. | 18,850 | 0.60% |

| AUTO-OWNERS INSURANCE COMPANY | 7,352 | 0.20% | |||

| Under Review | A u | PROTECTIVE INSURANCE CORPORATION | 15 | 0.00% | |

| Positive Total | 26,217 | 0.80% | |||

| Unrated or Withdrawn-Pre 2019 Total | 9,649 | 0.30% | |||

| Grand Total | 3,207,502 | 100.00% | |||

1 AMB financial strength ratings, actions, and outlook/implication per AM Best as of 6/1/2021. Ratings “under review” have a “u” indicator after the rating. Rating is for the AMB rating unit that includes the LASLI company.

2 Ultimate parent as of 6/1/2021.

3 Premiums registered through 5/31/2021.

In addition to a financial strength rating, AM Best includes a rating outlook (stable, negative, or positive) indicating the potential future direction of the rating over an intermediate term (about 36 months). For ratings that are under review, the potential future direction is called a rating implication (negative, developing, and positive) and the forward-looking timeframe is more near-term (typically 6 months).

Stable Outlook (95.3% of 2021 YTD Premium Registered)

- Most groups have AM Best ratings with a stable outlook, with most ratings affirmed stable (93.8% of 2021 YTD premium registered).

- The company withfinancial strength rating downgrade was:

- AXIS Capital Holdings Limited/AXIS Surplus Insurance Company (A) and AXIS Specialty Europe SE (A): Downgrade due todeterioration in operating performance, which is no longer in line with companies with a strong operating performance assessment.

- The company with afinancial strength rating upgrade was:

- AXA SA/T.H.E. Insurance Company (A+): Upgrade due tothe efforts to simplify the post-merger AXA XL organization. As a result, T.H.E. Insurance Company has been incorporated into the operations and financials of XL Bermuda Ltd. which affords it more implicit and explicit support.

Negative Outlook/Implication (1.9% of 2021 YTD Premium Registered)

- Several groups and their respective LASLI companies have negative outlooks or implications on their financial strength ratings. The percentage of premium written by insurers with a negative outlook or implication decreased to 1.9% of 2021 YTD registered premium compared to 6.5% of 2020 registered premium.

- One Group and their respective LASLI company with an affirmed ratings and negative outlooks:

- United Fire Group River Group Inc./Mercer Insurance Company (A): Downward trend in recent underwriting performance, stemming from numerous catastrophe events as well as reserve strengthening in the commercial auto liability line in 2019. While the group is executing on an enterprise-wide strategic plan to improve operation and financial performance, it faces execution risk due to competitive market conditions and ongoing exposure to catastrophe events.

- Adverse reserve development within the commercial auto line in the excess and surplus segment during the first quarter of 2021. The downgrade also reflects a reduction in the assessment of the group’s enterprise risk management to marginal. The risk management capabilities of the organization proved to have weakness in risk tolerances, non-modelled risk, management controls and risk culture, according to AM Best. The negative outlook reflects AM Best’s concerns with the group’s balance sheet strength assessment given the recurring nature of the adverse development.

- One group and its respective LASLI company with negative implications as rating being under review:

- Watford Holdings Ltd./Watford Specialty Insurance Company (A- u): Significant exposure to investment losses stemming mostly from its non-investment grade bond portfolio, which is subject to significant unrealized losses if credit spreads widen. However, Watford continues to take steps to lower the risk profile on its investment portfolio, and could benefit by a proposed merger transaction with Arch Capital Group Ltd.

Developing Implication (1.6% of 2021 YTD Premium Registered)

- Group and their respective LASLI company with a rating downgrade and their ratings are under review with developing implications:

- Vault Holdings, LLC/Vault E&S Insurance Company (A- u): Due to announced agreement that Cornell Capital and Hudson Structured Capital Management Ltd. have jointly entered into an agreement to acquire majority ownership of Vault E&S Insurance Company. The rating is expected to remain under review until the transaction closes.

- Groups and their respective LASLI companies with their ratings under review with developing implications:

- Hallmark Financial Services, Inc./Hallmark Specialty Insurance Company (A- u): Rating placed under review following the announcement of a planned IPO of the specialty commercial business. Hallmark Financial Services plans to offer a noncontrolling ownership stake in the core business of its specialty commercial business segment. The ratings are expected to remain under review until AM Best can assess the ultimate organization structure of the group and its risk-adjusted capital position.

- Core Specialty Insurance Holdings, Inc./StarStone Specialty Insurance Company (A- u): Rating place under reviewing following the announced planned merger agreement with Lancer Insurance Group. The status reflects the potential execution risks associated with the two group’s merging, the need to fully assess the financial and operational impacts of the merger, offset by the potential synergies recognized from this transaction. AM Best does not anticipate positive rating movement at the immediate close of the merger, however the diversification of the business profile and the fortified management team could favorably impact rating dynamics as the new combined business model matures.

- ProAssurance Corporation/Norcal Specialty Insurance Company (A- u): Rating placed under review following the announcement that ProAssurance Corporation would acquire NORCAL Group. Although the transaction was completed in May, the developing implications remain reflecting the potential for the ratings to be lowered if the balance sheet strength assessment were to decline due to the demutualization. There is also a potential for NORCAL Group’s ratings to be stabilized or enhanced once support from ProAssurance Corporation can be determined by AM Best.

Positive Outlook/Implication (0.8% of YTD 2021 Premium Registered)

- Groups and their respective LASLI insurers with a positive outlook on their financial strength ratings which were affirmed:

- Selective Insurance Group/Mesa Underwriters Specialty Insurance Company (A): Reflects improved profitability over the past five years on an absolute basis and relative to its peers.

- Auto-Owners Insurance Company/Atlantic Casualty Insurance Company (A): Reflects improved underwriting performance in recent years, consistently favorable reserve development and increased efficiencies through investments in technology.

- One group and its respective LASLI insurer with positive implications as rating being under review:

- Protective Insurance Corporation/Protective Specialty Insurance Company (A u): Announcement that the group has entered into a definitive agreement to be acquired by The Progressive Corporation. Protective will become part of a larger organization with a strong market reputation and expanded geographic footprint.

Hot Topics – Merger Activity

| Merger, Acquisition and Other Corporate Transactions - LASLI Insurance Groups - 2021 1 | ||||

| Acquirer | Target | LASLI | Premiums Registered by SLA - YTD 2020 ($000's) | Stage |

| Potential Offer | ||||

| Allianz SE | Hartford Financial Services Group Inc.(Hartford) | Navigators Specialty Insurance Company (T) | $156,208 | Allianz SE is exploring an offer for The Hartford. |

| Pacific Insurance Company, Limited (T) | $13,292 | |||

| Maxum Indemnity Company (T) | $12,953 | |||

| Nutmeg Insurance Company (T) | $0 | |||

| Interstate Fire & Casualty Company (A) | $83,432 | |||

| Allianz Global Corporate & Specialty SE (A) | $11,293 | |||

| Offered/Rejected | ||||

| Chubb Limited | Hartford Financial Services Group Inc. (Hartford) | Navigators Specialty Insurance Company (T) | $156,208 | Chubb Limited made three offeres (on March 11th & 30th and on April 14th, 2021) to aquire Hartford group, Hartford rejected all three offers. On April 28th, 2021, Chubb Limited announced that it is no longer interested in pursuing a takeover of Hartford group. |

| Pacific Insurance Company, Limited (T) | $13,292 | |||

| Maxum Indemnity Company (T) | $12,953 | |||

| Nutmeg Insurance Company (T) | $0 | |||

| Westchester Surplus Lines Insurance Company (A) | $145,072 | |||

| Illinois Union Insurance Company (A) | $95,245 | |||

| Chubb Custom Insurance Company (A) | $24,112 | |||

| Chubb European Group SE (A) | $11,279 | |||

| Executive Risk Specialty Insurance Company (A) | $171 | |||

| Announced | ||||

| Pedal Parent Inc. (owned by affiliates of TowerBrook Capital Partners LP and Further Global Capital Management) | ProSight Global, Inc. | Gotham Insurance Company (T) | $17,526 | Announced: 01/15/2020 Anticipated Completion: 3Q2021 |

| Arch Capital Group Ltd. | Watford Holdings Ltd. | Watford Specialty Insurance Company (T) | $6,683 | Announced: 09/08/2020 Anticipated Completion Date: 1H2021 |

| Arch Specialty Insurance Company (A) | $78,287 | |||

| Arch Insurance (UK) Limted (A) | $1,749 | |||

| Cornell Capital (private equity investor) and Hudson Structured Capital Management (asset manager doing its reinsurance business as HSCM Bermuda) | Vault E&S Insurance Company | Vault E&S Insurance Company (T) | $931 | Announced: 11/12/2020 Announced Anticipated Completion Date: End of Q12021 |

| Lancer Financial Group, Inc. | Core Specialty Insurance Holdings, Inc | StarStone Specialty Insurance Company (T) | $29,172 | Announced: 4/16/2021 Anticipated Completion date: 3Q2021 |

| Completed 2021 | ||||

| Third Point Reinsurance Ltd. | Sirius International Insurance Group, Ltd. | Sirius International Insurance Corporation (T) | $4,509 | Completed: 02/26/2021 |

| ProAssurance Corporation | Norcal Group | NORCAL Specialty Insurance Company (T) | $6,820 | Completed: 05/05/2021 |

| ProAssurance Casualty Company (A) | $8,227 | |||

| Noetic Specialty Insurance Company (A) | $5,179 | |||

| Progressive Corporation | Protective Insurance Corporation | Protective Specialty Insurance Company (T) | $0 | Completed: 06/01/2021 |

| Intact Financial Corp., Tryg A/S | RSA Insurance Group PLC | The Marine Insurance Company (T) | $3,293 | Completed: 06/01/2021 |

| Completed 2020 | ||||

| SkyKnight Capital, L.P., Dragoneer Investment Group and Aquiline Capital Partners LLC | StarStone U.S. Holdings, Inc | StarStone Specialty Insurance Company (T) | $29,172 | Completed: 11/30/2020 |

| Tokio Marine Holdings Inc | Privilege Underwriters, Inc | Houston Casualty Company (A) | $181,965 | (Privilege Underwriters) Completed: 2/10/2020 |

| Tokio Marine Specialty Insurance Company (A) | $45,134 | |||

| Safety Specialty Insurance Company (A) | $7,875 | |||

1 Information as of 5/31/2021

2 Names of LASLI Subsidiaries or Applicants are followed by either a (T) for Target or an (A) for Acquirer.

3 LASLI/Eligible Subsidiaries includes LASLI companies but excludes Lloyd’s Syndicates and NRRA eligible subsidiaries with premium registered below a minimum threshold. For 2021, the threshold is $5.0 million.

- Progressive Corporation: Completed an acquisition of LASLI Insurer Protective Insurance Corporation on June 1st, 2021. Protective Insurance Corporation is Progressive Corporation’s first subsidiary that is on the LASLI as they look to expand and add products that will help support larger fleets and brings expertise in worker’s compensation coverage for the transportation industry.

- ProAssurance Corporation: After navigating several regulatory hurdles, completed the acquisition of the Norcal Group including LASLI Insurer Norcal Specialty Insurance Company, combing two professional liability writers.

Hot Topics – Developing

- E&S Premium Volume: Both external sources and internal data indicate a growth in market participation. According to AM Best’s market segment report, newcomers, along with a commitment from existing participants, show a healthy interest in the specialty commercial market. Internally, the SLA has seen an increase in the numbers of insurers inquiring about joining the LASLI. Total California direct premiums written by the US LASLI Insurers increased 13.5% through the first five months of 2021 compared to the same period in 2020.

- COVID-19 Claims: Monitoring the impact of COVID-19 claims on the LASLI groups. Reporting on COVID-19 claims is available for approximately half of all the insurers on the LASLI through Standard & Poor’s Market Intelligence product. Insurers without data available were manually reviewed. Based on information available from Market Intelligence, the following table shows the top five Insurer Groups based on COVID-19 claims as a percentage of total capital:

At the Lloyd’s of London market, the COVID-19 pandemic resulted in £3.4 billion of major claims for 2020. This accounted for 13.3 percentage points of a reported combined ratio of 110.3% in 2020. Steps are being taken to monitor individual syndicate impacts.

Premium Registered By Ultimate Parent1 – Top Groups – 2021(January through May)

| AMB Ultimate Parent1 | Operating Company | Status2 | AMB Financial Strength Rating3 | YTD 2021 Premium REGISTERED ($000's) | YTD 2021 Premium REGISTERED (% of Total) |

| LLOYD'S | LLOYD'S OF LONDON | Non-LASLI | A | 793,375 | 17.79% |

| LLOYD'S Total | 793,375 | 17.79% | |||

| MARKEL CORPORATION | UNITED SPECIALTY INSURANCE COMPANY | LASLI | A | 160,011 | 3.59% |

| EVANSTON INSURANCE COMPANY | LASLI | A | 108,413 | 2.43% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 7,347 | 0.16% | |||

| SUPERIOR SPECIALTY INSURANCE COMPANY | LASLI | A | 0 | 0.00% | |

| MARKEL CORPORATION Total | 275,771 | 6.18% | |||

| NATIONWIDE MUTUAL INSURANCE COMPANY | SCOTTSDALE INSURANCE COMPANY | LASLI | A+ | 213,849 | 4.80% |

| NATIONWIDE MUTUAL INSURANCE COMPANY Total | 213,849 | 4.80% | |||

| FAIRFAX FINANCIAL HOLDINGS LIMITED | CRUM & FORSTER SPECIALTY INSURANCE COMPANY | LASLI | A | 47,104 | 1.06% |

| ALLIED WORLD NATIONAL ASSURANCE COMPANY | LASLI | A | 40,345 | 0.90% | |

| ALLIED WORLD SURPLUS LINES INSURANCE COMPANY | LASLI | A | 38,974 | 0.87% | |

| HUDSON EXCESS INSURANCE COMPANY | LASLI | A | 38,103 | 0.85% | |

| HILLTOP SPECIALTY INSURANCE COMPANY | LASLI | A | 12,187 | 0.27% | |

| SENECA SPECIALTY INSURANCE COMPANY | LASLI | A | 6,167 | 0.14% | |

| FIRST MERCURY INSURANCE COMPANY | LASLI | A | 6,067 | 0.14% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 0 | 0.00% | |||

| FAIRFAX FINANCIAL HOLDINGS LIMITED Total | 188,948 | 4.24% | |||

| AMERICAN INTERNATIONAL GROUP, INC. | LEXINGTON INSURANCE COMPANY | LASLI | A | 111,979 | 2.51% |

| AIG SPECIALTY INSURANCE COMPANY | LASLI | A | 40,667 | 0.91% | |

| WESTERN WORLD INSURANCE COMPANY | LASLI | A | 22,683 | 0.51% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 3,236 | 0.07% | |||

| AMERICAN INTERNATIONAL GROUP, INC. Total | 178,565 | 4.00% | |||

| W. R. BERKLEY CORPORATION | ADMIRAL INSURANCE COMPANY | LASLI | A+ | 55,533 | 1.25% |

| GEMINI INSURANCE COMPANY | LASLI | A+ | 45,760 | 1.03% | |

| NAUTILUS INSURANCE COMPANY | LASLI | A+ | 31,651 | 0.71% | |

| BERKLEY ASSURANCE COMPANY | LASLI | A+ | 13,427 | 0.30% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 3,312 | 0.07% | |||

| W. R. BERKLEY CORPORATION Total | 149,682 | 3.36% | |||

| BERKSHIRE HATHAWAY INC. | NATIONAL FIRE & MARINE INSURANCE COMPANY | LASLI | A++ | 99,422 | 2.23% |

| GENERAL STAR INDEMNITY COMPANY | LASLI | A++ | 22,365 | 0.50% | |

| MOUNT VERNON FIRE INSURANCE COMPANY | LASLI | A++ | 9,081 | 0.20% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 6,983 | 0.16% | |||

| BERKSHIRE HATHAWAY INC. Total | 137,851 | 3.09% | |||

| CHUBB LIMITED | WESTCHESTER SURPLUS LINES INSURANCE COMPANY | LASLI | A++ | 65,470 | 1.47% |

| ILLINOIS UNION INSURANCE COMPANY | LASLI | A++ | 37,581 | 0.84% | |

| CHUBB CUSTOM INSURANCE COMPANY | LASLI | A++ | 19,666 | 0.44% | |

| CHUBB EUROPEAN GROUP SE | LASLI | A++ | 5,330 | 0.12% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 0 | 0.00% | |||

| CHUBB LIMITED Total | 128,046 | 2.87% | |||

| SOMPO HOLDINGS, INC. | ENDURANCE AMERICAN SPECIALTY INSURANCE COMPANY | LASLI | A+ | 103,214 | 2.31% |

| ENDURANCE WORLDWIDE INSURANCE LIMITED | Non-LASLI | A+ | 10,433 | 0.23% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 50 | 0.00% | |||

| SOMPO HOLDINGS, INC. Total | 113,698 | 2.55% | |||

| AXA SA | INDIAN HARBOR INSURANCE COMPANY | LASLI | A+ | 99,027 | 2.22% |

| XL CATLIN INSURANCE COMPANY UK LIMITED | Non-LASLI | A+ | 7,113 | 0.16% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 298 | 0.01% | |||

| AXA SA Total | 106,438 | 2.39% | |||

| TOKIO MARINE HOLDINGS, INC. | HOUSTON CASUALTY COMPANY | LASLI | A++ | 81,313 | 1.82% |

| TOKIO MARINE SPECIALTY INSURANCE COMPANY | LASLI | A++ | 15,255 | 0.34% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 4,067 | 0.09% | |||

| TOKIO MARINE HOLDINGS, INC. Total | 100,635 | 2.26% | |||

| ALLEGHANY CORPORATION | LANDMARK AMERICAN INSURANCE COMPANY | LASLI | A+ | 68,009 | 1.53% |

| CAPITOL SPECIALTY INSURANCE CORPORATION | LASLI | A | 19,242 | 0.43% | |

| FAIR AMERICAN SELECT INSURANCE COMPANY | LASLI | A+ | 6,091 | 0.14% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 3,970 | 0.09% | |||

| ALLEGHANY CORPORATION Total | 97,312 | 2.18% | |||

| LIBERTY MUTUAL HOLDING COMPANY INC. | IRONSHORE SPECIALTY INSURANCE COMPANY | LASLI | A | 56,577 | 1.27% |

| LIBERTY SURPLUS INSURANCE CORPORATION | LASLI | A | 33,124 | 0.74% | |

| LIBERTY MUTUAL INSURANCE EUROPE SE | LASLI | NR | 7,103 | 0.16% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 445 | 0.01% | |||

| LIBERTY MUTUAL HOLDING COMPANY INC. Total | 97,249 | 2.18% | |||

| MUNCHENER RUCKVERSICHERUNG AG | GREAT LAKES INSURANCE SE | LASLI | A+ | 45,983 | 1.03% |

| PRINCETON EXCESS AND SURPLUS LINES INSURANCE COMPANY | LASLI | A+ | 42,283 | 0.95% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 4,676 | 0.10% | |||

| MUNCHENER RUCKVERSICHERUNG AG Total | 92,942 | 2.08% | |||

| THE HARTFORD FINANCIAL SERVICES GROUP, INC. | NAVIGATORS SPECIALTY INSURANCE COMPANY | LASLI | A+ | 71,684 | 1.61% |

| MAXUM INDEMNITY COMPANY | LASLI | A+ | 5,444 | 0.12% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 2,893 | 0.06% | |||

| NUTMEG INSURANCE COMPANY | LASLI | A+ | 0 | 0.00% | |

| THE HARTFORD FINANCIAL SERVICES GROUP, INC. Total | 80,022 | 1.79% | |||

| ASSOCIATED ELECTRIC & GAS INSURANCE SERVICES LIMITED | ASSOCIATED ELECTRIC & GAS INSURANCE SERVICES LIMITED | Non-LASLI | A | 75,346 | 1.69% |

| ASSOCIATED ELECTRIC & GAS INSURANCE SERVICES LIMITED Total | 75,346 | 1.69% | |||

| ARGO GROUP INTERNATIONAL HOLDINGS, LTD. | COLONY INSURANCE COMPANY | LASLI | A- | 51,086 | 1.15% |

| PELEUS INSURANCE COMPANY | LASLI | A- | 22,364 | 0.50% | |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 628 | 0.01% | |||

| ARGO GROUP INTERNATIONAL HOLDINGS, LTD. Total | 74,078 | 1.66% | |||

| EVERGREEN PARENT, L.P. | ASSOCIATED INDUSTRIES INSURANCE COMPANY, INC. | LASLI | A- | 65,940 | 1.48% |

| OTHER AFFILIATES WITH PREMIUM REGISTERED <$5.0M | 1,766 | 0.04% | |||

| EVERGREEN PARENT, L.P. Total | 67,706 | 1.52% | |||

| All Other Groups <$67.0M in Premium Registered | 1,462,997 | 32.81% | |||

| Taxable Fees | 24,303 | 0.55% | |||

| Total Premium Registered and Taxable Fees | 4,458,814 | 100.00% | |||

1 Ultimate parent per AM Best as of 5/31/2020.

2 Status as of 5/31/2021. An insurer merged with and into another LASLI carrier is reported as having a LASLI status if premiums registered are significant.

3 AMB financial strength rating per AM Best as of 6/1/2021. Lloyd’s syndicate rating = AM Best rating of the Lloyd’s market.

Premium Registered By Lloyd’s Syndicates With Managing Agent1 – 2021 (January through May)

| LLOYD'S | YTD 2021 Premium Registered ($000's) | YTD 2021 Premium Registered (% of Total) |

| Lloyd's Syndicate 2623 (Beazley Furlonge Limited) | 128,022 | 16.10% |

| Lloyd's Syndicate 33 (Hiscox Syndicates Limited) | 49,120 | 6.20% |

| Lloyd's Syndicate 2987 (Brit Syndicates Limited) | 42,214 | 5.30% |

| Lloyd's Syndicate 3624 (Hiscox Syndicates Limited) | 34,258 | 4.30% |

| Lloyd's Syndicate 510 (Tokio Marine Kiln Syndicates Limited) | 32,144 | 4.10% |

| Lloyd's Syndicate 1458 (RenaissanceRe Syndicate Management Limited) | 31,526 | 4.00% |

| Lloyd's Syndicate 623 (Beazley Furlonge Limited) | 28,409 | 3.60% |

| Lloyd's Syndicate 1969 (Apollo Syndicate Management Limited) | 27,724 | 3.50% |

| Lloyd's Syndicate 1084 (Chaucer Syndicates Limited) | 18,849 | 2.40% |

| Lloyd's Syndicate 4444 (Canopius Managing Agents Limited) | 18,350 | 2.30% |

| Lloyd's Syndicate 1414 (Ascot Underwriting Limited) | 17,496 | 2.20% |

| Lloyd's Syndicate 2001 (MS Amlin Underwriting Limited) | 16,819 | 2.10% |

| Lloyd's Syndicate 2121 (Argenta Syndicate Management Limited) | 16,770 | 2.10% |

| Lloyd's Syndicate 1686 (AXIS Managing Agency Ltd.) | 16,345 | 2.10% |

| Lloyd's Syndicate 1880 (Tokio Marine Kiln Syndicates Limited) | 15,243 | 1.90% |

| Lloyd's Syndicate 2488 (Chubb Underwriting Agencies Limited) | 15,077 | 1.90% |

| Lloyd's Syndicate 2003 (Catlin Underwriting Agencies Limited) | 14,534 | 1.80% |

| Lloyd's Syndicate 457 (Munich Re Syndicate Limited) | 13,852 | 1.70% |

| Lloyd's Syndicate 1861 (Canopius Managing Agents Limited) | 13,845 | 1.70% |

| Lloyd's Syndicate 609 (Atrium Underwriters Limited) | 13,809 | 1.70% |

| Lloyd's Syndicate 1225 (AEGIS Managing Agency Limited) | 12,702 | 1.60% |

| Lloyds Syndicate 1886 (QBE Underwriting Limited) | 10,952 | 1.40% |

| Lloyd's Syndicate 1183 (Talbot Underwriting Ltd) | 10,882 | 1.40% |

| Lloyd's Syndicate 1200 (Argo Managing Agency Limited) | 9,818 | 1.20% |

| Lloyd's Syndicate 4472 (Liberty Managing Agency Limited) | 9,170 | 1.20% |

| Lloyd's Syndicate 435 (Faraday Underwriting Limited) | 7,258 | 0.90% |

| Lloyd's Syndicate 4711 (Aspen Managing Agency Limited) | 7,247 | 0.90% |

| Lloyd's Syndicate 1919 (Starr Managing Agents Limited) | 6,959 | 0.90% |

| Lloyd's Syndicate 4000 (Hamilton Managing Agency Limited) | 6,616 | 0.80% |

| Lloyd's Syndicate 1274 (Antares Managing Agency Limited) | 6,535 | 0.80% |

| Lloyd's Syndicate 1729 (Asta Managing Agency Ltd) | 6,417 | 0.80% |

| Lloyd's Syndicate 1991 (Coverys Managing Agency Limited) | 6,342 | 0.80% |

| Lloyd's Syndicate 1967 (W. R. Berkley Syndicate Management Limited) | 6,212 | 0.80% |

| Lloyd's Syndicate 4020 (Ark Syndicate Management Limited) | 5,494 | 0.70% |

| Lloyd's Syndicate 2791 (Managing Agency Partners Limited) | 5,492 | 0.70% |

| Lloyd's Syndicate 318 (Cincinnati Global Underwriting Agency Limited) | 5,048 | 0.60% |

| All Other Lloyd's Syndicates with Premium Registered <$5.0M & Other2 | 105,825 | 13.30% |

| Lloyd's Total | 793,375 | 100.00% |

1 Source: AM Best as of 6/1/2021 and Lloyd’s List of Active Syndicates & Managing Agents for 2021 Year of Account

2 All Other includes Lloyd’s premium registered with a missing or invalid syndicate number